|

Do not sell under panic. Hold your position. The market will go back up. Those who have been in crypto a little longer has seen this trend wash, rinse, repeat over and over. Just go look at the buy walls. The pros are buying up all the coins. For what? So that they can cash out again when the next waves of newbies get in the game. In fact, the 1st August BTC fork was supposedly more devastating but Bitcoin survived, unscathed. What's up with BTC prices? It was already headed for a correction around the 4.8k mark, the recent China ban on ICO coins just rattled people and 5 billion got withdrawn from the crypto pool. Let's talk about that for a bit. Word from the ground in China is that the crypto craze has produced over 4000 shitcoins there, many scams, and rich traders abusing the market. The government had to come in to enforce some regulations to protect people from themselves. Because that sort of wild west activity will only hurt the crypto market in the long run. Also I think what China wants to do is buy time to figure out how they can be the lead in the great crypto/blockchain race. Regulations by the way is a double edged sword. It protects newcomers and legit businesses but penalises the resourceful ones from profiting from a free market. So it depends on which side of the fence you are on, you are either going to enjoy the next part of the journey or hate it. I have massive love for crypto. It's a job and a hobby. And I'd be damned to see new folks get lost in this game and hating crypto because they got off on a bad start. I'm gonna start a brand new account on an exchange and guide you all the way from day 1. You follow what I do and let's see if you can figure your way around without losing money in the mean time. I starting with 1k and working my way towards 1 million. I will be posting regular updates on fb.me/CryptoCentral.net. Either you're a low budget trader, or a trader with huge capital, or someone who wants to build a mining farm, come talk to me. Leave me a comment here and get in touch with me through the links below. Join Me In Discussion Onwww.facebook.com/CryptoCentral.Net

www.steemit.com/@EugeneTay www.medium.com/@eugenetay www.EugeneTay.com

1 Comment

The Blockbuster Etheruem Meetup with Keynote Speaker Vitalik Buterin on the 16th of August 2017 had the largest turnout to date with an approximately 250 attendees packing the first and second level of SGInnovate, a co-working space and venue partner of the event organized by Ethereum Foundation, Singapore, and DigixGlobal. The number of interested participants however were more than the venue could accommodate. There were another 350 names on the waitlist and more than 10,000 views on the YouTube Live Stream channel. Buterin walked in around 6.40pm wearing a Hard Fork Cafe T-Shirt and in dark blue bermuda, totally going against the decorum that older, traditional folks would come to expect of keynote speakers. But this is the Founder of Ethereum and in the sphere of cryptocurrency, this eccentric genius is revered to divine levels by some, and by the way his fans rushed up on stage for a photo opportunity, you would be forgiven for thinking that this was a Kpop concert. The topics covered for this event were on the upcoming slated release of Metropolis, and the update on where Ethereum was headed with Proof of Stake. Buterin opened the session giving newbies a detailed overview about cryptocurrency, blockchain, and smart contracts, before diving into the technicalities of sharding and the impact it has on security. Midway through the speech, someone hung a makeshift banner at the back of the room with the handwritten text 'Buy $NEO', which in turn prompted Buterin to respond with: 'Don't buy NEO, sell your NEO'. Scalability has been one of the hottest issue this year and Bitcoin recently took centerstage with its forking drama in July this year. Bitcoin can handle three transactions per second; Ethereum at five. This is in stark contrast with PayPal and Visa capability in handling 190 and 1,600 transaction per second respectively. The current figures cannot hold if the volume of crypto users increase to reach mainstream adoption. The technical challenge would be to improve scalability without compromising security while still maintaining the integrity of a decentralised network.

The proposed solution is 'Sharding'. Sharding splits the space of each contract into smaller subspace - 'shards' - based on the first digit of their addresses. The workload of validation is divided to handle batches of allocated shards, and since each node on the network does not have to validate all transactions, the network can effectively handle more volume without impacting transaction time. Details of Sharding can be found in this link. You can see the video recording of the event in this video link. Notable members of the crypto universe spotted at the event were Dr. Julian Hosp and Toby Hoenisch from TenX, Yusho from Coinhako, and Valentin Preobrazhenaky from LAToken. You can download the Howdy App or Meetup App and search for Ethereum Singapore to get news on the next Ethereum event. Filecoin has attracted many attention even before their ICO as with their innovative promises to provide users with a comprehensive Blockchain-based data storage network.

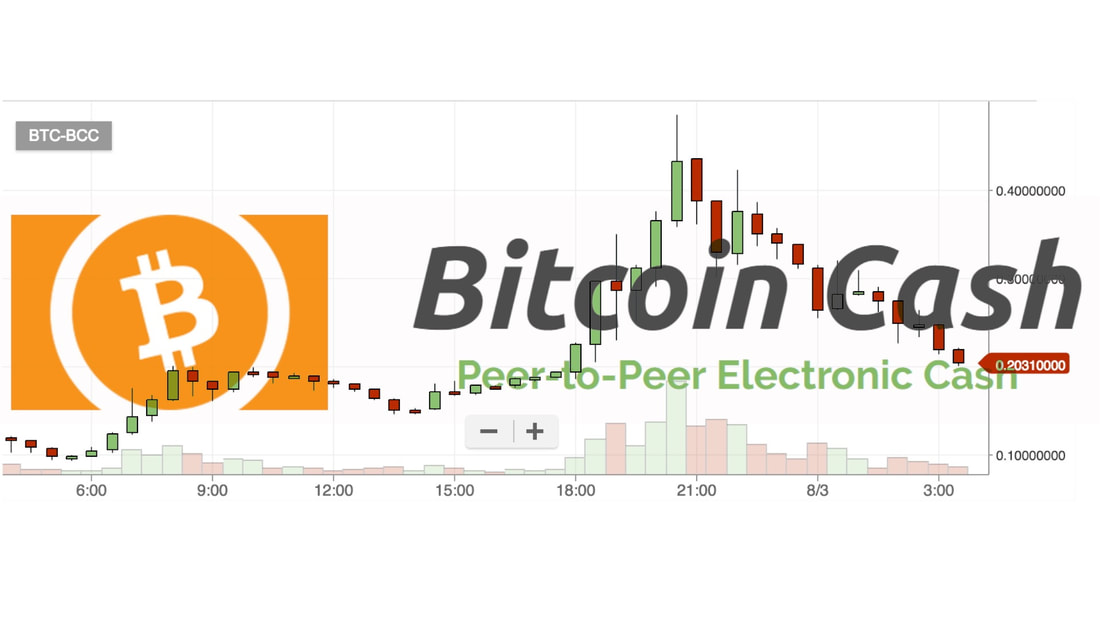

Today, the platform accumulated over $200 million USD within 60 minutes of its initial coin offering (ICO) phase. This includes the $52 million USD raised during its pre-sale – the sale of coins before ICO to highly speculative investors. The ICO is co-managed by CoinList, a joint project between start-up investment platform AngelList and Protocol Labs, the developer of Filecoin. However, just an hour after the ICO commenced at 1p.m. PT, the sale was put on halt as with enormous traffic flocking into the website – many faced problems accessing the site. The unbearable amount of web-traffic can be much blamed at the sales model of Filecoin’s ICO in which the price of coins increases as with the increased number of investors. Many flocked into the website in a bid to purchase the coins before the price went up. Putting all the problems aside, Filecoin has set a new high record in the world of cryptocurrency. Just over 30 minutes into the ICO, the Filecoin team announced that they have accumulated a total of $252 million USD in investments. This amount of investment is the largest to date in the world of cryptocurrency ICOs – overtaking the $232 million record hit by Tezos project in mid-July. It is believed that until now, over $1.7 billion USD have been invested into all cryptocurrency ICOs. Filecoin has just pushed the total figure into the $2 billion USD mark with its record-high ICO! It just go to show that investors are highly bullish about cryptocurrencies as with their promising ideas, solutions, and technologies. It is exciting to witness new history being made in the cryptocurrency world. Many analysts say that this is still pretty much the beginning phases of cryptocurrency. Just imagine how much more investments and innovations will be coming out of the cryptocurrency industry! This is definitely something to look out for! The market has been performing exceeding well this past couple of weeks and if you've always been on the sidelines wondering how to get in on the action but don't know where to start, just drop me a message. You don't have to be a trader to make money. There are other ways to earn a little coin here and there, which over time, can accumulate to quite a tidy sum if you start now. Bitcoin’s hard fork has been completed successfully. Say hello to your new cryptocurrency which is very similar yet different to Bitcoin, the Bitcoin Cash. Everybody who is supporting the alternative had trouble breathing as they long waited for the currency’s first block to be mined. Six hours to be exact. They were finally able to breathe as the first block of Bitcoin Cash was mined at roughly around 2:14 p.m. (ET) today. This made it official that some miners have moved on from Bitcoin to further accomplish their mining journeys with Bitcoin Cash which has a different technical roadmap, development team, users, and community. The first block was mined by a mining company called ViaBTC and this was an event which occurred approximately six hours after Bitcoin’s block number 478,558 – the block whereby miners pushed their attempts to separate (fork). The first block of Bitcoin Cash contained over 6,900 transactions, doubled number of transactions as compared to Bitcoin’s original chain. The currency is currently ranked as the third most traded cryptocurrency on CoinMarketCap with its market cap exceeding $7 billion USD. Its price initially dropped to around $210 USD but quickly recovered and is currently being traded at around $900 USD as we speak. The currency is currently available for trade on these exchanges: Bittrex, Kraken, ViaBTC, BTER, HitBTC, YoBit, Cryptopia, Novaexchange, The Rock Trading, Stocks.Exchange, CoinExchange At this point of time, it is rather meaningless to fight over which currency is better than the other. Many who thought Bitcoin Cash would crash were disappointed to see the opposite happening, though it's also important to note that the bloat in pricing could be due to more people buying into Bitcoin Cash out of fear of losing out and not enough people being able to sell their Bitcoin Cash as only selected exchanges are ready for trade. Many believe that Bitcoin Crash will see a steep decline if more exchanges allow BCC/BCH trade. However, many were also wrong about a lot of things about the fork. One simply cannot underestimate the power of greed. It doesn't matter that Bitcoin Cash was a duplication from the original blockchain stack, and that money was made out of thin air so to speak. It doesn't matter that the integrity of Bitcoin and digital currency has been, in my opinion, sullied. It doesn't matter that this whole fork smells like a not-so-elaborate ploy by miners to maintain the worth of their equipment and for some key players to profit from this. None of these matter because the prospect of getting Bitcoin Cash from merely holding Bitcoin prompted many people to buy into Bitcoin in the days leading up the 1st of August causing prices to bloat like crazy. It seems that the crowd has spoken. It's still too early for a celebration and like I always say, the cryptocurrency world is a crazy crazy place. You either love it or you hate it. As I mentioned in the previous update, I think the charts might flip over his head before the week is up. (Author's Note: The picture below is taken from a creative writing class I was teaching today. The kids wanted to write about space travel and I couldn't resist drawing the bitcoin logo on the rocket. I'm such a crypto geek, it's a wonder how my wife can stand me. It's about all I ever talk about these days.) Join us in discussion on:

www.facebook.com/CryptoCentral.Net www.steemit.com/@EugeneTay www.medium.com/@eugenetay www.EugeneTay.com If you would like to support me, you can send BTC to 39otZdtEjPDNVJ5wTk4oyHzfZjXxsGWXqj With the hard-fork happening today (1st August 2017), Bitcoin investors and traders will soon be able to decide their preferred version of the Bitcoin blockchain – Bitcoin Cash (BCC) and Bitcoin (BTC).

Bitcoin Cash (BCC) will be a complete duplicate of Bitcoin’s blockchain including all of its transaction history. All Bitcoin users will be provided with the exact amount of BCC as they had in bitcoins at the time of the fork. This means if a user had 1 BTC available on his/her wallet during the time of the fork, they will be eligible to claim 1 BCC on the Bitcoin Cash blockchain. This basically means ‘free money’ to those uninterested in the debate and will ultimately result in the ‘dumping’ of Bitcoin Cash (BCC). How about Bitcoin? Will its value ever be impacted by the existence of Bitcoin Cash and the dumping of the currency that is bound to occur? Not too long ago, a similar event took place with Ethereum whereby some members of the community decided to stick with the old platform that was hacked (The DAO incident). Apparently, the decentralization and ultimately, the democracy of the currency is far more important than the vulnerability of the platform for members who support the old platform. This resulted in two very similar yet different cryptocurrencies – Ethereum (ETH) and Ethereum Classic (ETC). Today, Ethereum Classic is traded at around $14 USD whilst Ethereum has thrived to reach a value of over $200 USD. Was Ethereum’s value ever affected by the existence of Ethereum Classic? Well, the answer is NO. These are treated as two separate cryptocurrencies/platforms with no correlation to one another except for the fact that they were once a single platform managed by the same development team. Looking at the case of Ethereum, we can know one thing for sure. Bitcoin Cash will be dumped indefinitely by users who are merely there for the ‘free money’ - as we have seen through the ‘dump’ of Ethereum Classic as soon as the fork was completed. Another thing we know for sure is that there will be lots and I mean, LOTS of confusions between Bitcoin and Bitcoin Cash, particularly between new Cryptocurrency users for the next couple of months and potentially years. But will Bitcoin’s value ever be affected by Bitcoin Cash? Well, Ethereum’s case tells us that it won’t. If anything, Bitcoin’s value will be far more strengthened upon the successful completion of the fork. After all, it is an update! The saddest part about this fork, for me at least, is that this is the end of the Bitcoin story. The Bitcoin fork which retains the BTC ticker does not follow the architecture that Satoshi Nakamoto had set, and while the Bitcoin Cash does follow its founder's vision, it has unfortunately been relegated to being an altcoin, shunned away by the crypto community. It's bloody heartbreaking. Subscribe to CryptoCentral Facebook Page to get the most crucial crypto news update in under 3 minutes. Banks and old fuddy duddies are increasingly vocal about their doubts over the practicality of cryptocurrency.

"It's fluff!" "It's not real!" "It's a bubble!" "It has no real world application." "It's not safe." All these talks of FUD (Fear, Uncertainty and Doubt) going around are not without its merit. How do you value something that is basically churned out of just computers crunching numbers and wasting electricity? Bitcoin has a finite supply which makes it valuable, but on that same vein, we also now see that it's just as possible to duplicate money with a declaration of a fork. Some merchants are accepting Bitcoin transactions, but the numbers are probably still lesser than the money-for-gold market in the Warcraft computer game community. So it's not surprising to see why so many folks from the older generation are not really embracing cryptocurrencies. The recent spat of hacking and malware news aren't really making it easy for the industry to stand tall as a credible and safe alternative to fiat currencies either. Perhaps the biggest mistake that the older generation can make about innovation is in trying to make sense of it. The young people don't have that problem. They grew up in a generation that pays real money for digital goods in games. Young people throw money around in support of products and ideas that they like on Kickstarter and Indiegogo, and sometimes these products never even see the light of day. We get apps like BigO turning unknowns into overnight minor celebrities and getting paid just by doing god-the-phark-knows-what it is that they do on BigO. A friend of mine gets paid in likes and BigO money for streaming herself having lunch. Mind blowing. Things are already happening around us that don't make sense. Maybe it's time we stop trying to hammer our understanding onto cryptocurrency based on old world beliefs. Francisco Blanch, Head of Global Commodities and Derivatives Research at Bank of America, believes that the only way to legitimize cryptocurrency is to instil legal framework and subjugate it with regulatory guidelines. A Morgan Stanley analysts’ report, written by James Faucet, and published in June 2017 states that cryptocurrencies are more like “investment vehicles” which are actually more inconvenient to use as a form of payment as compared to credit or debit cards. There are also no clear reasons as to why cryptocurrencies are increasingly becoming popular and are on a massive surge. But regardless of what I or you or Blanch or Faucet think about the future of cryptocurrency, the fact remains that right now, Bitcoin is averaging daily trades of $1 billion USD according to statistics in recent months. Daily trades sometimes exceeded $2 billion USD. Bitcoin's volatility has decreased as it builds liquidity and scale, but it's still not at the banking industry's comfort level. A lady I met on a cryptocurrency chat group who lives in Angola, South Africa, says that cryptocurrency was the only way that she and her people are able to circumvent ridiculous banking laws in their country which, she claims, seek to keep them in perpetual poverty. Countries are also finding it harder to keep their money and citizens in check especially with money moving around the digital sphere so freely. For every good that cryptocurrency brings to the table, there are also the darker side of the internet that proliferates from this. Countries and regulatory bodies are right in feeling like they got their testicles caught in a bear trap. However, for the most parts, I feel that FUDers, and even the reputable economist and financial analyst, Peter Schiff, just don't understand human behaviour and collective social mindset. Full recognition of the ideology and technology behind cryptocurrencies is essential when it comes to analysing this growing trend. It almost feels like if something seems too way out of our realm of understanding, we just brush it off as rubbish. Unless of course, they actually do understand the power of cryptocurrency and realised it to be a threat to their existence and the prevailing print-on-demand monetary system. That would make the most sense as to why thy try so hard to use whatever vestige of their authority to shut down cryptocurrency. So should we be worried about that? Well, here's the good news: The only way they can shut down cryptocurrency is to shut down the internet. Now, that's not going to happen is it? Welcome to the next level of industrial revolution, suckers. One of the coins that I've been a strong supporter off but too poor to afford to become a masternode of is Dash; but I'm working hard to change all that. One day... I shall own myself 1000 Dash coins. #DashHopes.

The chase towards the 1000 coins might be a little further now as I foresee Dash prices recovering quickly after his Bitcoin forking drama hot on the tails of the latest report that Apple has approved (and recognised) Dash as a digital currency and making Dash wallet available on the App Store. The official recognition by Apple of Dash as a digital currency is expected to have positive impacts on the currency, bolstering credibility and the use of the currency. Dash users can now confidently use official Dash wallets on their mobile devices. This is another sign that cryptocurrency is or has gone mainstream. The main concern that traditional investors have about cryptocurrency not having real world value is quickly eroding away with each new mainstream adoption. Say what you will about cryptocurrency being a pyramid scheme or a fad, but as an innovation cryptocurrency and blockchain technology is definitely going to be a disruptive market force in the next few years. You can either resist the change, or try to move with the times and benefit from this industrial revolution whether you believe in it or not. If you aren't too busy getting triggered reading social commentaries and have kept up to speed with the latest trends around the world, you might have noticed the word Bitcoin popping up more frequently than before. That's because Bitcoin is facing its biggest change since it was first discovered (it's more poetic than saying 'developed' or 'coded').

If you are still unsure if digital currency is a real thing or have never heard of it before, you are probably missing out quite a fair bit. Bitcoin, as well as many other cryptocurrencies are thriving to change the way how our traditional monetary system works. It has made banks look old-fashioned and physical money a useless paper waste. Some people even go as far as to forecast that fiat currency (that paper money in your wallet) will be worthless in the next generation or two. As a fan of the sci-fi game Shadowrun, the imaginative part of me can fathom a landscape where people carry around thumbdrives and pay in digital currencies. Below are the four ultimate reasons why you should start using Bitcoins right away: Anonymous If you are serious about privacy, pay attention. How many times have you been filling out forms be it online or offline only to provide your personal information like as if it means nothing? In a world where a simple search on Google can get you ‘stalking’ someone effortlessly, the issue of ‘privacy’ is becoming ever more important. No personal information is ever required for the use of Bitcoin. Transactions are handled out anonymously and you can send or receive money online at any time of the day from everywhere. Profitable Bitcoin is profitable in the sense that its value is expected to rise with time. This means you can earn profits merely by holding onto them. Just like all other fiat currencies, volatility exists. Daily traders take advantage of this volatility to earn profits by trading them into fiat currencies and vice versa. However, the major difference to note here is that the volatility of Bitcoin is much higher as with unregulated exchanges. The best thing? Its value has more than tripled ever since the beginning of 2017 and it is expected to steadily rise with time as predicted by major financial analysts and investors. Your due diligence is however, essential when making investment decisions! Anytime, Anywhere, Lowest Fees If you are someone who sends or receives large amounts of money internationally, you would want to pay attention to Bitcoin. Unlike banks, Bitcoin transactions can be handled at any time of the day from anywhere around the world. They are usually carried out instantly but require ‘confirmation’ time to verify your transaction – it usually takes no longer than 1 hour on average. When it comes to sending large amounts of money, especially to other parts of the world, bank fees can be hectic. With Bitcoin, transaction fees regardless of the amount being sent/received will never be more than a dollar. Stop worrying about bank holidays and hectic fees! Democracy Bitcoin is based on a decentralized network for everybody to use freely. This means no central authority or middlemen is involved with Bitcoin transactions. If you are not a fan of your Government watching every financial move you make, start using Bitcoins and support the financial revolution. In fact, the currency was created by Satoshi Nakamoto (the mysterious creator behind Bitcoin) over his frustrations and anger with the unpredictable monetary changes input by governments around the world. That’s right. He was fed up of hardworking people going bankrupt due to the mistakes of the banks and the government. Gain full control over your money and be your own bank with the use of bitcoins! Scamming and hacking and phishing and all the bad stuff you could possibly do on the internet, is plaguing the cryptocurrency universe. If you grew up during the 70s and witnessed how computers evolved, you would recall similar things happened back then too. Sci-Fi shows featuring hackers were all the rage then because security protocols were playing catch up with man's ingenuity.

Hackers are increasingly spreading malware which locks the operating system whilst requesting cryptocurrency payments for uninstallations. The Wannacry Malware is probably the most famous of them all. Another form of malware related to cryptocurrency is the ‘mining malware’. Once this malware is successfully deployed and installed, it starts mining various cryptocurrencies all the while the owners of the computers do not realize that their computers have been slowed down due to this malware. According to the Moscow-based news service RBC, a quarter of all computers operating in Russia have been infected with the cryptocurrency mining malware. This statement has been verified by Herman Klimenko, an advisor to President Vladimir Putin, as he told the local news agency that “20-30% of devices are infected with this virus”. Cryptocurrencies based on the proof-of- work (PoW) algorithm require users to input energy through the intensive ‘mining’ process in which computers are constantly used as they add new transactions on the Blockchain. New coins are minted (supplied) through this process and cybercriminals have long been generating funds by developing and distributing malicious applications and software which effectively hijack computers – to remotely control these computers, use their processing power, and mine various cryptocurrencies. On the other hand, various Russian government officials have pushed back his claims as they argue that such scale of infection is significant and would be hard to miss. “(the statement is) nonsense”, said Dmitry Marinichev, Russia’s internet ombudsman, in a recent interview with RBC. These pushbacks were further supported by Kapersky Lab, one of Russia’s leading anti-virus software developer, as they told RBC that merely 6 of its customers were ever targeted by this mining malware since the beginning of 2017. Furthermore, Doctor Web, another popular anti-virus vendor in Russia, stated the claim by Putin’s advisor as ‘faulty’ as the actual number of affected computers is significantly lower than the amount claimed. "If it were about 20-30%, it would be an epidemic and everyone would know about it. There are infections by miners, but it's impossible to say that they are infected with a third of users," said Vyacheslav Medvedev, an analyst for Doctor Web. Regardless of the truth behind Herman’s claim, it is true that mining malwares do exist. It is important that you are aware of its existence and regularly check your devices for potential infections. If your computer seems to have slowed down significantly and the use of your internet data have soared without much reasons, be sure to check your computer for this ‘mining malware’.  After all the depressing talk about forking and hacking, I want to talk about the brighter side of crypto and blockchain. Ever since the birth of Bitcoin, the art industry has always been around as they were fascinated with the currency’s features: instant, anonymous, low fees. Once the Blockchain technology was fully realized for its potentials, the art industry decided to stay around even closer as with copyright issues and keeping records of all art-piece related transactions. With the global art market valued at around $60 billion USD and high average amounts of purchase, the benefits of utilizing cryptocurrency as an additional payment form becomes obvious. Various artists and galleries at London’s Cork Street are increasingly accepting cryptocurrency payments in a bid to innovate their art empire. BBC has reported one such instance on Tuesday as they stated that Dadiani Fine Arts, an art gallery located at London’s Cork Street, has begun accepting cryptocurrency as a payment form in what its owner describes as an “intuitive” decision. The art gallery’s decision to accept cryptocurrencies is in fact, not a demand-driven decision to merely satisfy customer needs. Eleesa Dadiani, the owner of the gallery told BBC that this decision was in fact an intuitive move “…based on the way things are going”. This can be linked to the growing popularity of cryptocurrencies as various industries realize the true potentials of cryptocurrencies and their Blockchain based technologies. Dadiani Fine Arts Gallery currently accepts Bitcoin and is planning on accepting Ethereum, Ethereum Classic, Dash, Litecoin, and Monero in the near future. Dadiani says the Blockchain is the biggest thing to her ever since she learned about the Internet. The art industry is undergoing a dynamic and rapid change just like the Blockchain. Recently, an online art marketplace named ‘Artsy’ successfully collected over $50 million USD during their funding round, a process similar to cryptocurrency ICOs. Many investors and financial advisors were suspicious about the funding round in a manner ultimately similar to recent Ethereum-based ICOs as with the unknown actual valuation of the company. Regardless of their suspicions, these companies and platforms are successfully gathering funds to forward their research and development plans. These are indeed the ‘gray market’. The matter of the fact is that the $60 billion art market is increasingly utilizing cryptocurrencies and realizing their full potentials – partly for Blockchain’s dual ability to “establish the provenance of works of art and thereby reduce the reliance on brokers and other middlemen”, as reported by BBC. If you would like to support me, you may also send BTC and ETH to these addresses: Send BTC 39otZdtEjPDNVJ5wTk4oyHzfZjXxsGWXqj Send ETH 0x6ee765ca3112be7d9f43482bb28b2acbe6f07e2a |

Blockchain

|

RSS Feed

RSS Feed